News

Our Scrutiny team run a variety of different groups and projects, and with My Voice, there are 5 key…

Checking your smoke alarm and carbon monoxide alarm regularly is really important. Not only does it…

We do everything we can to prevent a fire from starting in your home but it's important to know what…

Our Money Advisor, Joanne, helped Mr Jones* clear his rent arrears by backdating 5 months’ worth of…

Recently, our Tenant Scrutiny team, along with some of our Involved Tenants, took a look into our Su…

There are a few things you can do to protect your home from fires. Investing in fire safety kits and…

Our Income team is there to help you manage your rent and to make sure we’re encouraging sustainable…

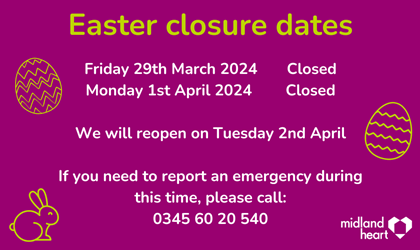

Our Customer Hub will be closed on Friday 29th March and Monday 1st April for the Easter bank holida…

We’ve spoken to Tracey, our Money Advice Manager, about what the team does and how they help our ten…