Call us on 03456020540

We're here to support you but we can only help if you let us know about your situation. We'll work with you to come up with a solution together.

What is a service charge?

A service charge is a fee for an extra service provided to your home. The service often covers a communal area that is shared with other properties in a block or on an estate. The expected cost of providing the service is split equally between the properties receiving the service.

My rent and service charge has changed, what do I need to do?

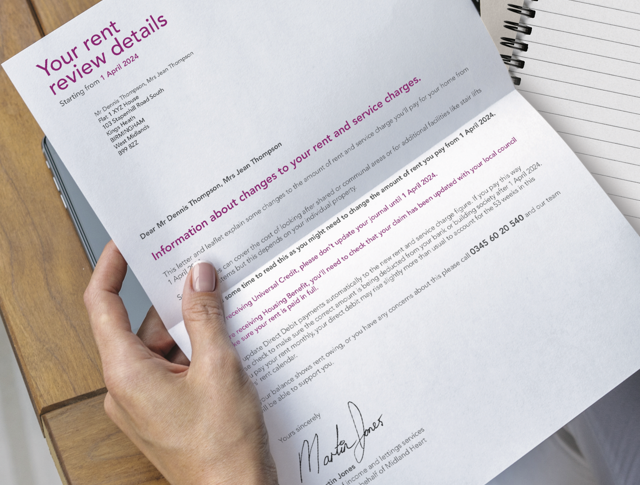

You may need to change the amount of rent you pay from 7th April 2025. You'll receive your annual rent and service charge review in the post which will tell you exactly how much you need to pay. Click here if you do not understand your rent review letter.

- If you pay your rent by Direct Debit we'll automatically update your payments for you.

- If you're receiving Universal Credit, please don't update your journal before 7th April 2025. You'll need to update it on or after 7th April 2025 to make sure you get your full entitlement.

- If you're receiving Housing Benefit you'll need to contact your local council to check that your claim has been updated.

Service charges you pay are made up of a mixture of known contract costs and estimates based on averages of past spends. We review services provided each year and adjust charges based on the latest cost information.

Most of our rented homes pay what are known as fixed service charges. This means at the end of the financial year – we will not send any additional bill if there has been an overspend and will not refund if we have underspent. The service charges for these properties are set in a way that averages out any difference over time.

We have variable service charges for our owned/shared ownership homes. We issue audited accounts out to residents each year and if the scheme has a surplus or a deficit this is rolled over to the next financial year for the scheme depending on the actual expenditure.

A surplus means if there is a credit that is passed over to the residents so they pay less for their service charges. If the scheme is running at a deficit, then residents will have to pay an additional charge to cover the cost of the deficit and so more for their service charges the following year.

You'll find a list of the service charges you pay on your annual rent and service charge review letter. View the tabs below for a more detailed breakdown of all the different service charges.

*(EB) means the charges are likely to be covered by Housing benefit or Universal Credit but this will depend on your local council.

CCTV (EB)

This covers any maintenance, servicing & unplanned repairs of a communal CCTV system.

Electric Gates (EB)

Covers all servicing visits & any unplanned repairs required.

Emergency Fire Light (EB)

Covers quarterly servicing & any unplanned repairs to the communal fire alarm & emergency lighting systems by our specialist fire safety contractors CCSS/Openview.

Emergency Lighting (EB)

Covers quarterly servicing & any unplanned repairs to the communal emergency lighting system only (no fire alarm) by our specialist fire safety contractors CCSS/Openview.

Emergency Lighting Testing (EB)

Covers testing visits received monthly for emergency lighting systems from CCSS/Openview to ensure they are in working order and adhere to fire safety regulations.

Entry Telephones/Door Entry (EB)

Covers maintenance, servicing & unplanned repairs to door entry intercom systems & receivers in flats.

Fire Detection (EB)

Covers quarterly servicing & any unplanned repairs to the communal fire alarm system only (no emergency lighting) by our specialist fire safety contractors CCSS/Openview.

Fire Extinguishers/Blankets (EB)

Covers the maintenance & replacement of any fire extinguishers/blankets in the communal areas.

Fire Testing (EB)

Our specialist fire safety contractors CCSS/Openview visit your property monthly to test fire alarm & emergency lighting systems. This is to ensure that systems are in full working order and adhere to fire safety regulations. This charge covers 8 standard flick tests. The quarterly servicing is then incorporated with the annual servicing visit covered under the maintenance service charge.

Legionella (EB)

Contract cost from our suppliers Orion who carry out legionella testing on all of the taps in the building & periodic cleaning of any water tanks on site.

Lift Maintenance (EB)

Cost for servicing, maintenance, unplanned repairs & insurance inspections of communal passenger lifts

Mobile Caretaker (EB)

Service from Safetynet – providing an out of hours service to respond to anti-social behaviour (ASB) within our communities. Safetynet will respond to ASB issues between 6pm and 6am, 7 days a week, 365 days a year. See attached leaflet for more information.

Rangers (EB)

Costs for Midland Heart’s ranger service - a team who deal with communal area inspections including fire safety checks and bulky waste removal/graffiti removal.

Specialist Baths (EB)

Contract cost – per bath covering maintenance, servicing and unplanned repairs of any baths with specialist hoists or access equipment.

Stair lift Maintenance (EB)

Contract cost for maintenance, servicing & unplanned repair costs for stairlifts in communal areas or private areas if our responsibility.

Transistor Maintenance Valves (EB)

Cost for maintenance and servicing of TMV’s – cost per TMV. TMV’s regulate the temperature of the water coming out of taps.

Warden Call – Housing Management

Cost paid to a 3rd party provider to answer emergency calls from the warden call system when no Midland Heart staff are present on site

Warden Call Maintenance

Covers maintenance, servicing & unplanned repairs to the warden call/emergency pull cord system.

Warden Call – Telephone Line Rental

Cost for the telephone line connecting the warden call system to a 3rd party provider responsible for answering emergency calls

Water/Sewage Pump Maintenance (EB)

Contract cost – for maintenance, servicing & unplanned repairs of specialist water or sewage pumps required in some areas with low water pressure.

*(EB) means the charges are likely to be covered by Housing benefit or Universal Credit but this will depend on your local council.

Grounds Maintenance (EB)

Contract cost from our Grounds Maintenance contractors: Idverde, Pinnacle, Maple, Dovetail or John O’Connor covering maintenance to communal grass, shrubs, hard standing areas & litter picking.

Tree Lopping service charge – Gardening (ad-hoc) (EB)

A global cost & contribution towards costs related to surveying trees & tree lopping – cutting back trees and removing dangerous/dead trees.

The charge includes surveys to all trees every 3 years and then any planned works required as part of these surveys. As such you would not expect tree works every year.

Window Cleaning (EB)

Contract cost from our window cleaning contractors to clean external windows. Contractors: Hi Spec, Sj Cleaning or Just Ask. Hi Spec have replaced Pinnacle due to poor tenant feedback in regards to window cleaning.

Communal Cleaning (EB)

Contract cost from our communal cleaning contractors Pinnacle or Just Ask to clean internal communal areas of properties.

Set based on past power usage and our suppliers knowledge of future utility prices.

*(EB) means the charges are likely to be covered by Housing benefit or Universal Credit but this will depend on your local council.

Set based on past power usage and our suppliers knowledge of future utility prices.

Digital TV Aerial (EB)

Covers any maintenance & unplanned repairs of a communal TV aerial.

Electrical Consumables (EB)

Costs incurred for replacement of consumable electrical items in communal areas such as light bulbs, fuses etc.

Electricity – Communal (EB)

Covers electricity supply to communal areas

Electricity – Personal Charge

Covers electricity supply to your personal property. This is charged in properties where there is only one communal meter rather than separate electricity supplies.

Gas – Communal (EB)

Covers gas supply to communal areas

Gas – Personal Charge

Covers gas supply to your personal property. This is charged in properties where there is only one communal meter rather than separate gas supplies.

Telephone Costs (EB)

Costs incurred for the previous year related to telephone costs required for the running of the scheme. Including landlines & staff mobiles.

Water – Communal (EB)

Covers water supply to communal areas

Water – Personal Charge

Covers water supply to your personal property. This is charged in properties where there is only one communal meter rather than separate water supplies.

*(EB) means the charges are likely to be covered by Housing benefit or Universal Credit but this will depend on your local council.

Amenity Charge

Ineligible charge – often used for ineligible salary charges + other miscellaneous HB ineligible charges most commonly Lifeline charge across retirement properties.

Bulky Waste Removal & Fly Tipping (EB)

For costs related to ad-hoc bulky waste/fly tipping removal from outside properties, or ad-hoc outside cleaning. Also can include skip hire & collection.

Communal Decoration (EB)

Contribution towards communal decoration and furnishings within the communal areas of the scheme.

Council Tax (EB)

Cost for council tax paid for Midland Heart – passed on via the service charge.

Cleaning Expenditure (Materials) (EB)

Costs for spends on cleaning materials & equipment for the cleaning of the communal areas. Can also covers spends for items such as toilet rolls, hand sanitiser etc.

Clinical and Sanitary Waste (EB)

Costs from our specialist contractors relating to regular clinical/sanitary waste removal from sanitary bins or sharps boxes.

Communal Laundry Expenditure (EB)

Costs related to maintenance of communal laundry facilities for maintenance visits & replacement parts– often from our contractors Multibrand. Should not include replacement machines as these should be capitalised.

Communal Repairs (EB)

Costs for miscellaneous repairs to communal areas not included within other maintenance costs. Can include repairs to communal boilers, wiring, and communal doors

Customer Wellbeing

Cost for wellbeing advisors and activities – ineligible for housing benefit so separated from other salary costs.

Employee Salaries – Scheme (EB)

Covering the HB eligible element of salaries for staff at the scheme for housing management related services. Including caretakers, scheme managers, administrators, cleaners and other roles.

Health & Safety (EB)

Costs related to health & safety around the building including signage, deep cleans, specialist rails, gloves, first aid kits etc.

Insurance Charge

Charge for building insurance for shared owners/leaseholders only. Is covered under the rent for rented properties.

Management Charge (Wkly) (EB)

The management charge is calculated at 15% of all HB eligible service charges. This covers costs for setting up and managing the various contracts to deliver services at our properties.

Management Charge (Wkly) INELIGIBLE

The management charge is calculated at 15% of all HB ineligible service charges, similar to above.

Office equipment - Hire & Maintenance (EB)

Costs related to rental / maintenance of office equipment used for documentation relating to residents. This often is for rental of printers/photocopiers.

PAT Testing (EB)

Cost incurred by Midland Heart relating to PAT testing for items within communal areas

Pest Control (EB)

Costs incurred for pest control or pest prevention services from our contractor Orbis Including bait boxes, removal of wasp nests. Some schemes will have a regular contract – whereas for most this is an ad-hoc service.

Provision of Service Chargeable Assets (Depreciation) (EB)

The cost of installing large items & systems at schemes including fire alarms, door entry system, Lifts, TV Aerial systems, Warden call systems, CCTV, communal furniture etc. The cost of these items is split over the estimated lifespan of the system. Please note – this charge is only for rented customers, not leaseholders or homeowners.

Refuse Collection (EB)

For regular collection of large paladin bins from schemes by a contractor not covered by council tax.

Renewals & Replacements (EB)

Costs for replacement of small items of furniture & fittings & miscellaneous items (under £500) for the communal areas of the scheme

Rent/Service Charge Payments to 3rd Parties (EB)

Cost from 3rd party estate management companies for communal services. These costs are paid by Midland Heart & passed onto residents via the service charge.

Sinking Fund

Similar to depreciation for leasehold properties but paid for in advance. This charge is paid into a communal sinking fund which will pay for the leaseholder’s share of large installs/works at the scheme.

TV Licence, Other Entertainment

Cost for TV licence for communal areas plus any other entertainment subscriptions if provided.

Voids Cover (EB)

A percentage of other service charges – normally 5% or less to ensure services provided are viable in the case of voids within the scheme

White Goods (EB)

Maintenance cost for repairs to white goods including fridges and ovens etc. that are the responsibility of Midland Heart. Please note – the vast majority of white goods are residents responsibility.

- What are the different types of rent?

- Why has my rent gone up?

- What if I disagree with my rent increase?

You can find out what type of rent you pay in your tenancy agreement. Here is some information about the different types of rent:

Social rent

This type of rent is set based on a formula set by the government. It takes into account the valuation of a property, alongside size & local area average earnings to calculate a target rent for your property.

Increases to social housing rents are calculated using September’s consumer price index (CPI) rate +1%. For 2025 - 2026, the rent increase is 2.7%.

Affordable rent

This type of rent is set at 80% of the market rent including all service charges. Increases are set out by the government rent policy.

Secure rent

Also known as fair rents, this type of rent is applicable if you started your tenancy before 15th January 1989 or if you transferred internally from another fair rent tenancy. The amount of rent we charge here is set by the Valuation Office Agency (VOA) – we apply to register your rent & service charges every 2 years to the VOA

Shared Ownership

If you own part of a property under the shared ownership scheme, you'll rent for the percentage you do not own. The amount you pay will be laid out in your lease.

If you disagree with your rent or service charge, you can get advice from the Leasehold Advisory Service here.

Every year we review the rent that you pay for your home. We use a formula given to all Councils and Housing Associations by the Government.

In April 2020 the government has announced that rents will rise by CPI + 1% from. You can read more about this here.

The aim of the annual review is to create a fair system for customers regardless of whether they are a council or housing association tenant. Customers should be paying a similar rent to others living in the same size property in the same area.

The rent review takes into account several factors:

- The size of the property

- The valuation of the property

- The average household income for the county in which you live

Rent increases

- The Government sets a maximum increase level for any single year. Most of the rent increases occur in the first week of April.

- We'll write to you before any increase, giving a calendar month notice of the planned rent increase

What does my rent cover?

The rent you pay gives you the right to live in your home. It includes building insurance as well as some repairs and maintenance to your home and the fabric of the building. If you own part of your home you may be responsible for insurance & repairs. You can find out what repairs we are responsible for here.

If you disagree with the proposed new rent and you wish to appeal, then you must make an application of appeal to First Tier Property.

First Tier Property is an independent body and they have very strict timelines. You must make your application of appeal within one calendar month of you receiving your rent review letter.

If you make an application after one calendar month, it will be dismissed.

The details of the First Tier Tribunal are:

First Tier Tribunal

Midlands Region

Residential Property

Centre City Tower

5-7 Hill Street

Birmingham

B5 4UU

Tel: 0121 600 7888

Fax: 01264 785 122

E-mail: rpmidland@hmcts.gsi.gov.uk

This office covers the following:

Metropolitan districts: Birmingham, Coventry, Dudley, Sandwell, Solihull, Walsall, Wolverhampton.

Unitary authorities: Derby, Leicester, Rutland, Nottingham, Herefordshire, Telford and Wrekin and Stoke on Trent.

Counties: Derbyshire, Leicestershire, Nottinghamshire, Shropshire, Staffordshire, Warwickshire and Worcestershire.

To see our Rent and Service Charge Policy, please click here.