When you own a shared ownership property, you have the option to buy more shares of that property. This is known as staircasing.

There's some key information you need to know about staircasing and if you're interested you should send an initial email to leaseholdservices@midlandheart.org.uk, who'll then send you the next steps. We’ve also pulled this handy information pack all about staircasing which you might find useful.

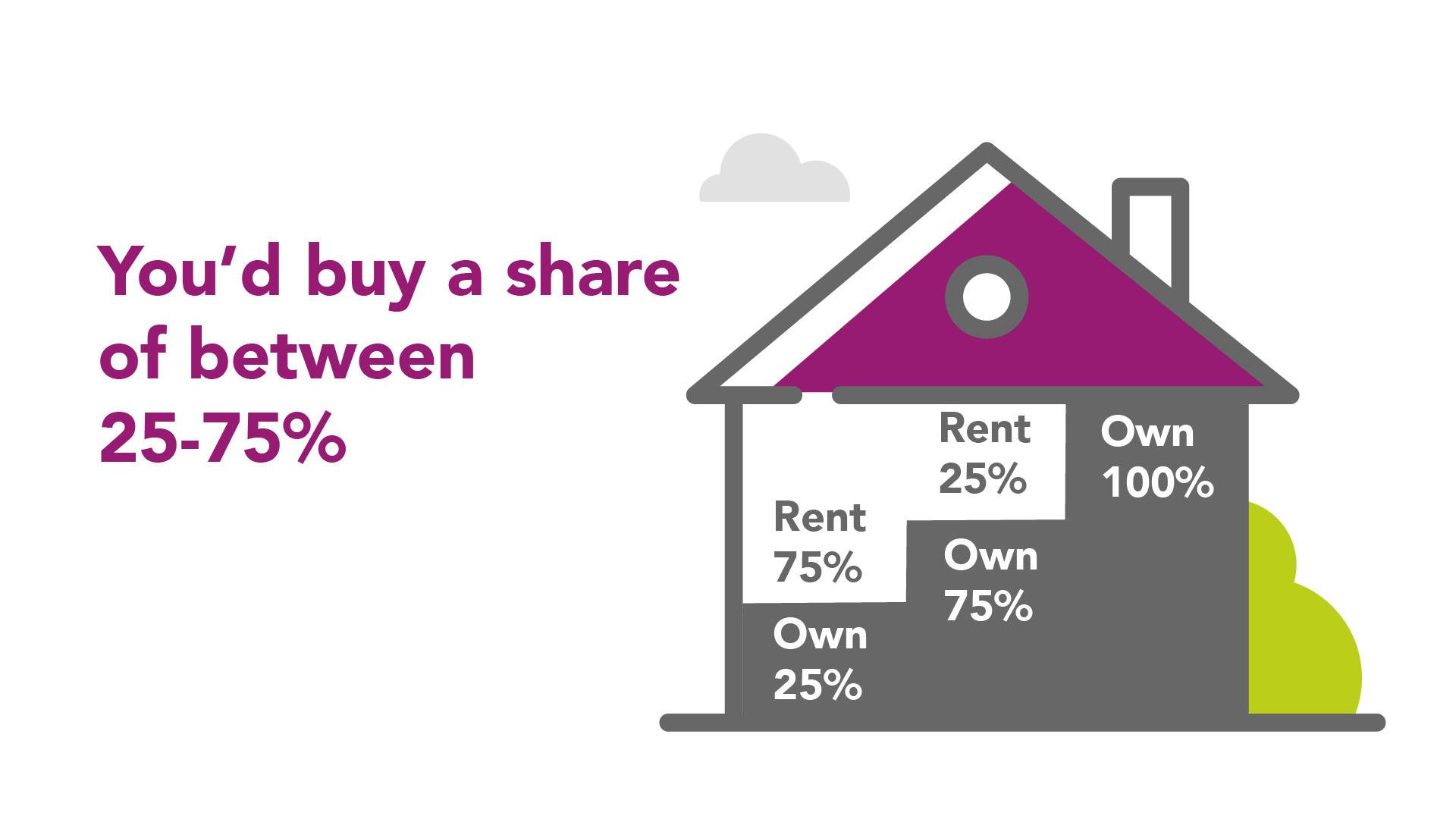

Buying more shares in your home is known as staircasing. As you buy more of your home, the rent you pay us will reduce.

You won’t pay rent once you’ve purchased all of the shares in your home (and therefore own 100%) but you may still pay a service charge if there are areas around the estate which we maintain.

If you need any further help or would like more information about staircasing then please call us on 0345 60 20 540.

The rent you pay us is simply to cover the shares of your homes that we still own. When you bought your home, we too will have taken a loan to cover the percentage you do not own. The rent you pay goes towards paying that loan off as well.

Your rent is calculated each year and your lease will say how it will be. Normally your rent will increase by the Retail Price Index (RPI) + a percentage as set out in your lease. This means that the increase in your rent will be impacted by what is going on in the economy with such things as interest rates and inflation.

The more shares you own, the less rent you’ll pay.

The cost of buying shares in your home will depend on the current market value of your home.

We'll need a updated valuation of your home so that we can accurately cost the remaining shares. When we've got this cost, you can decide whether you want to proceed with buying more shares.

You can find out how much your valuation will be by seeing our Fee Schedule.

You'll need to pay for the new valuation of your home.

The valuation needs to be carried out by a Royal Institute Chartered Surveyor (RCIS) and we have a handful of approved valuers that we use.

The valuation only lasts for 3 months. So, if it takes longer than this for you to complete the purchase of your extra shares, you'll need to pay for a new valuation.

It's worth remembering, as you purchase more shares of your home the amount you pay us in rent each month will decrease.

When you staircase, there are some other fees which you may need to think about before you begin the process. These will likely be the cost of instructing a solicitor to act on your behalf. Normally you can agree a fixed fee with a firm of solicitors.

If you staircase to 100%, you'll own the home fully and it won't be considered a shared ownership property anymore.

You'll no longer be a Midland Heart tenant and won't have to pay us rent.

If you have communal areas, you may still need to pay a service charge for the upkeep of these. Your Leasehold Officer will be able to advise you on this.

The Shared Ownership model was created to help households with lower incomes and first-time buyers on to the property ladder. Getting to a position where you own 100% shares in your home and possibly using that as a deposit on your next home is the best way to get the most from Shared Ownership.

We understand that plans change over the years which means owning 100% of your home may not be affordable or possible, which is fine. However, if that is the case then you will continue to pay rent on the part of your home we own. The rent you pay is explained in the tab above "Why I pay rent on shares...".

Buying more shares in your home is a legal process, which means it will largely be down to your solicitors (and ours) to progress to completion. However to help give an understanding, we have broken the process down as follows:

- Pre-Valuation Stage: This is the point where you decide that you want to explore purchasing further shares.

- Valuation Stage: At this stage, you need to instruct and pay for a valuation of your home so that we can understand what you’ll need to pay for the additional shares you want to buy. You aren’t obliged to continue with the staircasing if the shares are unaffordable, but you do still have to pay for the valuation itself either way.

- Instructing solicitors – you need to instruct solicitors to represent you and let us know who they are. It’s worth comparing prices of a few solicitors and trying to find one that offers a fixed fee to help with your budgeting.

- Drafting of legal documents – this will be completed by your solicitors and ours - they will draft and agree all the necessary documents.

- Completion: This is when the process is all finished; the monies are paid and you’ll receive a memorandum of staircasing to confirm your new percentage. If you have purchased 100% and we own the freehold, then this will be transferred to you.

If you would like more information or begin the process of staircasing, please ring 0345 60 20 540 and speak to our Housing Advice Team.

Please only fill out the form below if you have already paid your valuation fee.